THE RESPONSIBILITIES OF THE PENSION FUND

Almost all businesses in Switzerland are subject to the Occupational Pensions Act or OPA. The provisions of the OPA are mandatory for sole proprietors and for companies which are entered in the Swiss commercial register as legal entities, for example joint stock companies (AG) and limited liability companies (GmbH), and which employ people who are required to pay old-age and survivors’ insurance contributions (OASI).

Your pension fund contribution is calculated on the basis of your pension plan at Integral and your annual salary. The contribution paid by your employer is calculated as a percentage of your OASI annual salary. Normally the employer and the employee pay half of the contribution each. The amount you pay as an employee is deducted from your salary and shown on your salary statement.

Your pension savings capital is recorded in your pension account. Each insured person at Integral has their own individual pension account based on their pension plan. The total of all the amounts in your pension account, plus interest, makes up your retirement assets or pension savings capital. The current amount of your retirement assets is shown on your pension statement.

If you move to a new job, you will leave your existing pension fund. Your new employer will enrol you in their company pension fund. In accordance with the law on occupational pensions in Switzerland, your retirement assets are transferred from your existing pension fund to the new one. In the financial sector, this amount is known as your vested benefits.

In the context of the stock exchange, a risk is often only understood to be a risk of imminently losing your money. In fact, from the perspective of a period of more than a year, a risk can also be a potential profit that is ultimately realised. The terms “risky” and “risk” are therefore not appropriate to describe the activities on the financial markets. They can be better and more accurately described as volatile or characterised by volatility.

Integral sees itself specifically as a pension fund characterised by fairness and social engagement. This is why the idea of solidarity is important to us. We are also fully aware of the realities of modern society. For example, around 40 percent of marriages in Switzerland end in divorce. In some cases, people get divorced after retiring and this can sometimes have serious financial consequences. Providing that all the conditions have been met, Integral will pay a full divorced person’s pension in accordance with the regulations. This will not be restricted to the minimum requirements of the Occupational Pensions Act (OPA).

Naturally, Integral analyses the potential risk before preparing an offer for companies interested in affiliating with the fund. This involves investigating the company’s record of losses over the last five years and the structure of insured people.

Integral does not cross-subsidise profitable and high-risk customers. In addition, it does not cherry-pick potential affiliated companies. The pension recipients of an interested company will be taken over in full by Integral, providing it is possible to demonstrate that the pensions are adequately funded.

When disaster strikes, it’s good to be prepared. But it’s even better to ensure that disaster does not strike in the first place. Integral, the pension fund from Graubünden, works with you to help prevent illness and invalidity within your business. We take these measures seriously, because reducing the number of claims brings benefits for everyone.

Encouragement of home ownership

The Occupational Pensions Act allows pension assets to be used for the purchase of residential property or allows the purchase to be funded by pledging the early withdrawal of pension scheme assets. This is known as the encouragement of home ownership and the process is referred to as the early withdrawal of pension scheme assets for the purchase of residential property.

This early withdrawal can be made for the purchase and the construction of residential property, for the extension or conversion of residential property which represents an investment, for the repayment of a mortgage and for the purchase of shares in cooperative residential associations. The law does not permit an early withdrawal to finance a second or holiday home or to pay mortgage interest.

An early withdrawal often results in a reduction not only in retirement benefits, but also in risk benefits. You can take out a voluntary additional insurance policy with an insurance company to cover the reduction in the risk benefits.

Before submitting a written application for an early withdrawal, it is sensible to ask Integral first whether this is possible. This initial check will resolve questions such as: Is there enough money available? Is an early withdrawal permitted by law? What are the tax consequences?

Changes in your personal life

The simplest way of notifying Integral when you get married or enter into a registered partnership is to do this via your employer. Your employer will inform us about the change.

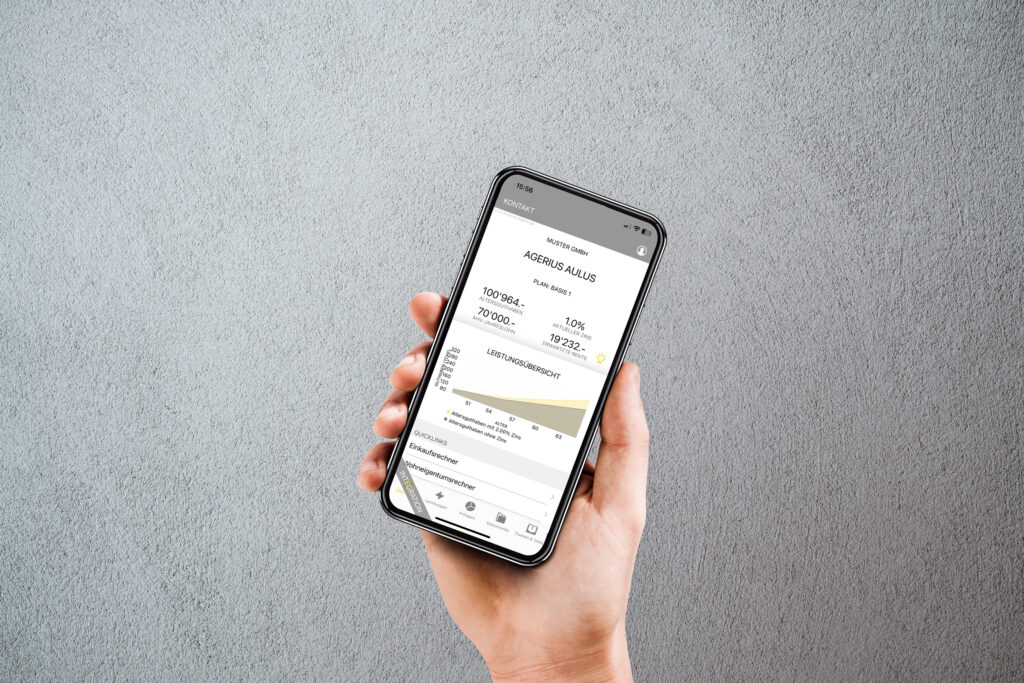

The best way of notifying Integral about a life partnership (cohabitation) is by using the app.

Divorce/separation

Before initiating divorce proceedings, it is sensible to find out yourself or with the help of your divorce lawyer what the consequences of a divorce will be for your pension savings capital. On request, Integral will provide you with the feasibility check declaration for the court.

When a legally valid divorce decree is submitted to Integral, the pension savings capital of both spouses is generally divided in half. The calculation of half of the pension savings capital is based on the difference between the assets at the time of the divorce and those at the time of the marriage.

The shortfall in the pension savings capital resulting from the divorce, which is known as the divorce withdrawal, can be made up at any time by means of voluntary contributions.